April 2013

Excerpts from the IREJ Healthcare Real Estate Conference

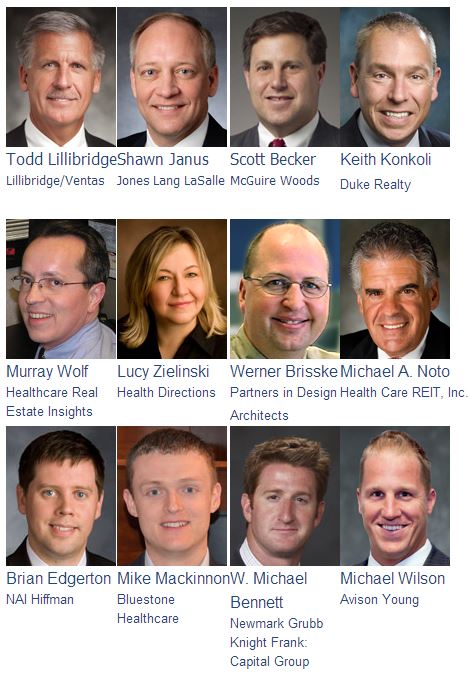

The following excerpts are from the IREJ Healthcare Real Estate Conference held this morning by RE Journals at the University Club of Chicago. The first panel addressed New Strategies in Healthcare – the State of the Market, moderated by Murray Wolf of Healthcare Real Estate Insights, Keith Konkoli of Duke Realty, Scott Becker of McGuire Woods, Shawn Janus of Jones Lang LaSalle, Todd Lillibridge of Lillibridge/Ventas, and Tina Wardrop of Health Directions LLC.

New Strategies in Healthcare – the State of the Market

8:28 – Shawn Janus: One of the reasons why we saw a decrease in activity [last year] was because cap markets were still rebounding, the supreme court made its ruling in healthcare reform, and there was the election. With all that behind us, moving into 2013, we will see greater activity. We’re going to see a lot more activity on the outpatient environment. The question is, will hospitals use their capital or third party capital?

8: 30 – Todd Lillibridge: it was only about 5 years ago that we had our economic meltdown. Where we are starting to see more action and pickup will be in 2014-2015. We don’t see it incrementally picking up in a big way until then.

8:32 – Scott Becker: Over the next couple of years, there are big projects, but you’re not going to see what you saw in the past few years like the movement of Children’s and Sherman hospitals…there will be a ton of smaller projects.

8:35 – Tina Wardrop: From the provider perspective, the impact of obamacare is creating a real need for physicians to spend more money on information technology. On the smaller office side, there is going to certainly be a need to reconfigure hospital space to handle new patient care.

8:44 – Keith Konkoli: Not a lot has changed in capital in the last 12 months, we don’t really get into the third party capital market, but there is so much capital chasing product but not enough product. It makes the competition that much greater.

8:46 – Lillibridge: We had about $5+ billion in transactions last year. In the 2007-2008 time frame, valuations of MOB peaked, what you’re seeing now is the need to exit based upon valuations and cap rates that are plateauing.

8:48 – Konkoli: [on hospital monetization] We are hopeful that there are more hospital monetizations. 35% of hospital capital now goes to facilities operations and development, our objective and hope is to help them free up some of that capital.

8:57 – Wardrop: The conflicting pressure is that you have to hire more people under obamacare, yet the reimbursement rates are going down…so at some point, there will be a breaking point. It’s blooming in the future.

8:59 – Janus: I don’t think we are the slowest sinking ship though. There are lots of financial pressures, but I do think healthcare isn’t as economic or cyclical driven as it is demographic driven. 10-15 years from now we’ll hit the peak of our number of users of healthcare from the baby boom population.

9:00 – Wardrop: I think that real estate needs to be flexible, able to move with the needs of patient care, the changes in technology (like telemedicine) and the changing of patients out of hospitals to ambulatory settings…communities are the whole focus of the future.

9:01 – Becker: You’ve got so many demographic trends at work…so much growth in population. The beauty of healthcare has always been that there are lots of buyers.

9:15- Konkoli: Opportunities are continuing to move off campus or away from campus…like its been said before, the way to reduce the cost of medicine is to remove it from the hospital setting…that’s where we look to find opportunities.

9:16 – Janus: What you’re seeing on our side of the industry is more and more players–and the nimble and niche players—that middle size firm.

Strategies in Medical Office Space

The following panel discussed Strategies in Medical Office Space with moderator Daniela Fitzgerald of Fitzgerald Earles Architects and Associates. Speakers included Brian Edgerton of NAI Hiffman, Werner Brisske of Partners in Design Architects, Michael Noto of Healthcare REIT, Inc. and Mike Mackinnon of Bluestone Healthcare.

9:48 – Brian Edgerton: You’ve got a very fragmented market here, there are a couple of drivers in play with the reutilization of the healthcare delivery model…having branding and signage as well as convenient access for patients–all in a more cost effective way–are the main drivers in the retail conversion of medical offices. You’re seeing several of our dialysis clinics seeking out former Borders book stores and Blockbuster video stores that are usual end cap retail spaces.They have great parking ratios and available signage–it’s about the convenience of care for the patients.

9:52 – Noto: There are challenges–retail space is not usually the same level of quality as when you build a medical building. When you get past the general issues that exist…the biggest challenge is tenant relation management.

9:56 – Brisske: The retailization—its all about being close to the patient and being accessible to the patient.

9:56 – Mackinnon: The issue with retail centers is that if you add a dialysis clinic, a true retail business like Panera may not want to be located right next to that.

10:04 – Brisske: There is also a drive for warmer finishes for a far more comfortable environment for healthcare system offices outside of hospitals…physicians are giving up some of their tradition perks…more and more are seeing shared office spaces with multiple physicians having a common area while they can still go somewhere to make private phone calls—which makes sense since they are in and out throughout the day.

10:11 – Edgerton: [on the trend towards more rehab and prevention facilities] the drivers are to obviously push everything to the outpatient experience–make it community based.

10:21 – Brisske: Convenience is huge. Walmart and Walgreens are out in front of it. How much other retailers will tack on to that, I’m not sure, its hard to tell.

10:25 – Noto: Things continue to change. The Supreme Court made their decision. Obama was elected. 10 years ago, I had no doctors. Today I have 3. I’m healthy, but I have 3. Multiple me by 78 million people and there’s your demand and driver. People will continue to be here, using more and more healthcare, and using it more often. As MOB owners, the advances are so rapid in technology that a doctor can treat you electronically. I can see that having a chilling effect on demand for medical office space.

10:28 – Edgerton: NAI Hiffman’s very optimistic with the niche market in Chicagoland. Of the roughly 400 medical office buildings that our research department tracks, the peak was 16% vacancy and the low was 8%. We like where we’re headed and we’re optimistic.