June 2013

REfocus: The Suburban Office Recovery

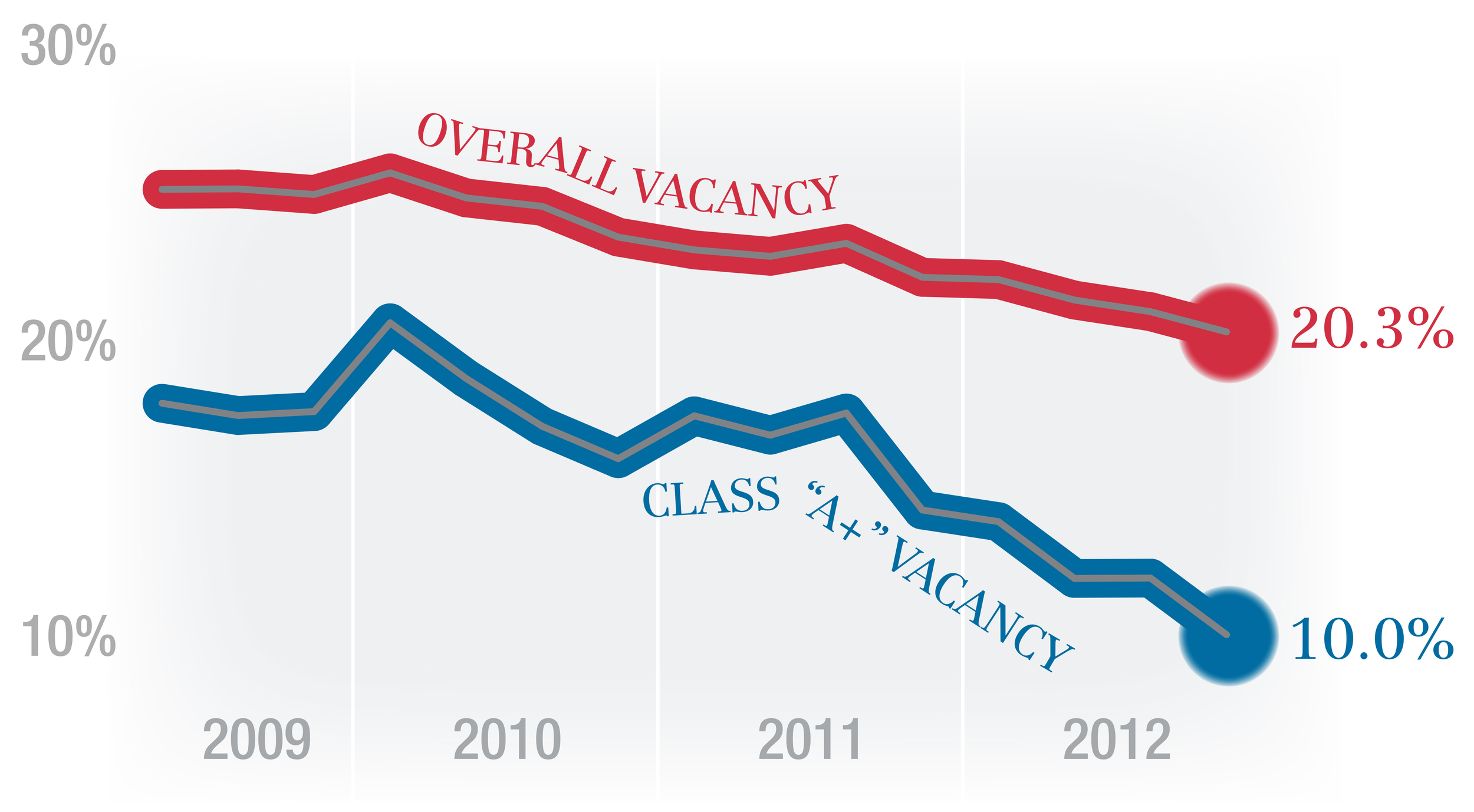

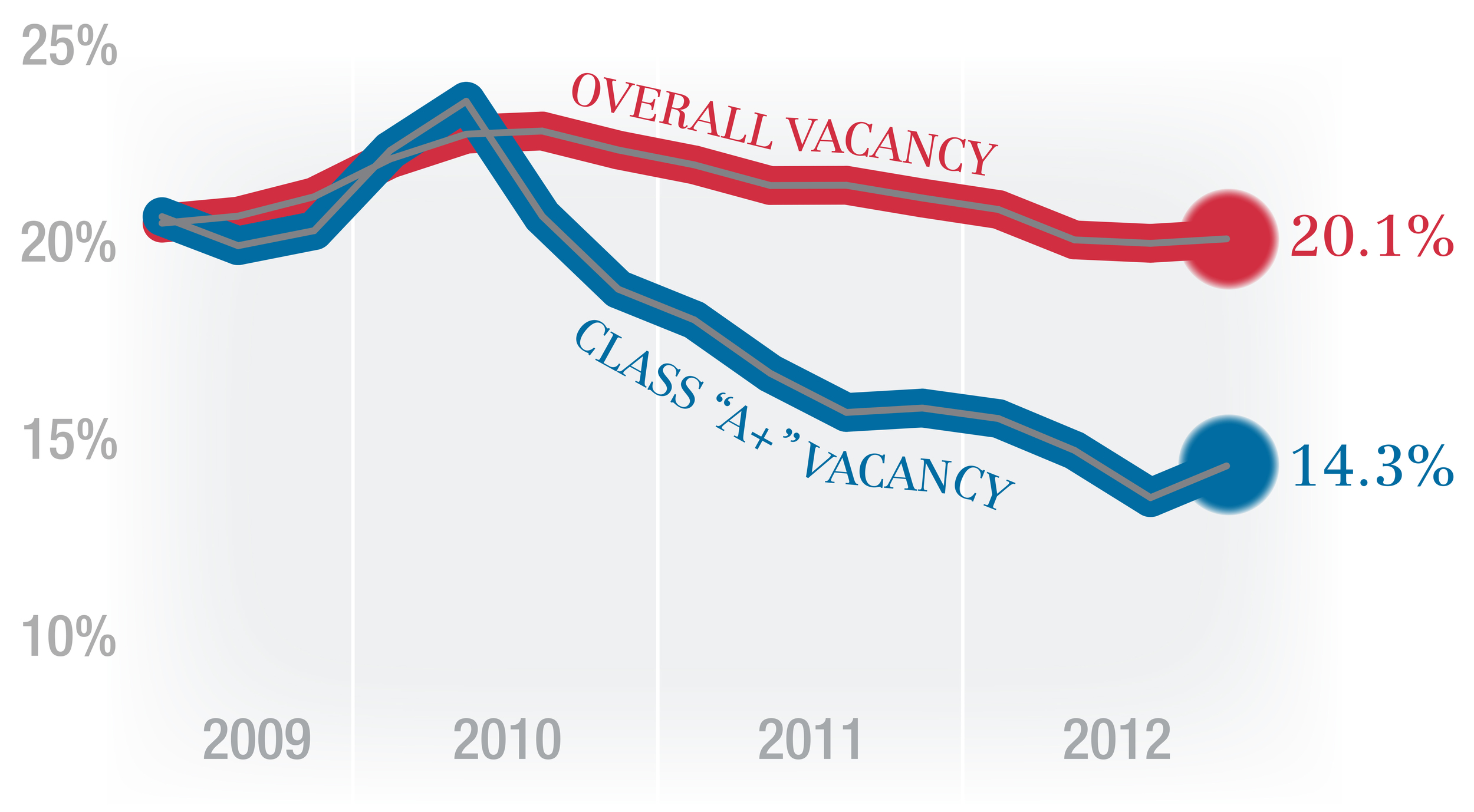

Our research team conducted a study on the best buildings in the market, or what some parties call “trophy buildings”. The vacancy rate among these highest-quality core buildings is far lower than the overall market’s vacancy rate and has been improving at a quicker rate through the recovery.

As an example, in the O’Hare market, vacancy in these buildings is only 10%, half of the 20% vacancy rate being reported for the overall O’Hare market. This impressive recovery means that demand is returning and owners will soon begin to push rental rates and reduce leasing concessions such as free rent and tenant improvement allowances.

As quality space continues to be leased in these class “A+” buildings, this demand and activity will trickle down to the market’s class “B” buildings due to few available options for tenants.

Not all owners have the financial means to provide the best amenities and concessions for their tenants. Companies will continue to flock towards the buildings that offer them the best environment to do business and provide the most value.

Companies wishing to take advantage of the ongoing recovery in the suburban Chicago market should review their current lease structure today. In select East-West Corridor buildings, rental rate increases have already begun. The Crossings in Oak Brook recently saw four tenants competing for the same 37,000 SF block of space which resulted in a quicker-than-normal negotiation process. The lease brought the building to 90% occupancy, allowing ownership to increase their asking rental rate by a full dollar. In buildings that have not yet increased their asking rates, leases are being signed much closer to the asking rate. This trend is the result of a widening gap of occupancy rates among the best properties in the corridor as compared to the rest of the marketplace.

As the economy improves there has been a “flight to quality” as tenants are looking for quality existing space in buildings with desirable amenities. To capitalize on this trend and shorten the transaction cycle, Class “A” buildings such as Commerce Plaza, among others, have built fully-furnished spec suites, a trend expected to continue in the coming year.

Click here to visit our full REfocus page for in-depth broker analysis on the suburban office markets.