April 2017

Central DuPage Market Trends

Overview

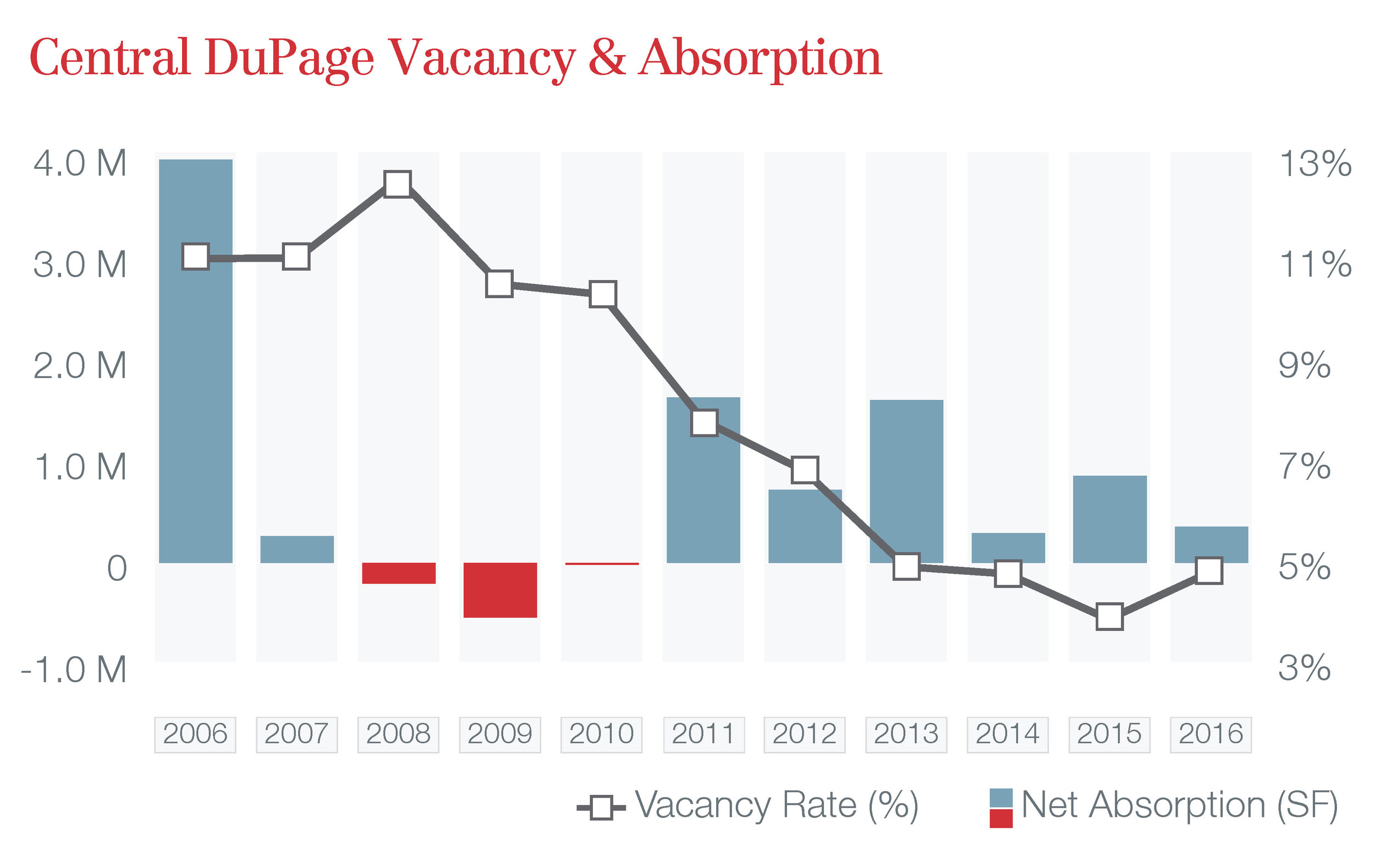

Historically, Central DuPage (CDP) has been viewed as one of Chicagoland’s core industrial submarkets. Comprised of nearly 70 million square feet of industrial space, many owners have highly sought after industrial assets in CDP for its proximity to major highway arteries, exposure to skilled labor, proximity to affluent municipalities, and favorable taxes. On a larger scale, Central DuPage is divided by I-355 into two smaller markets. Product east of I-355 is traditionally owner occupied, older vintage, and smaller lots/land parcels, while the product west of I-355 contains more institutional-quality assets.

The Central DuPage Cycle

-

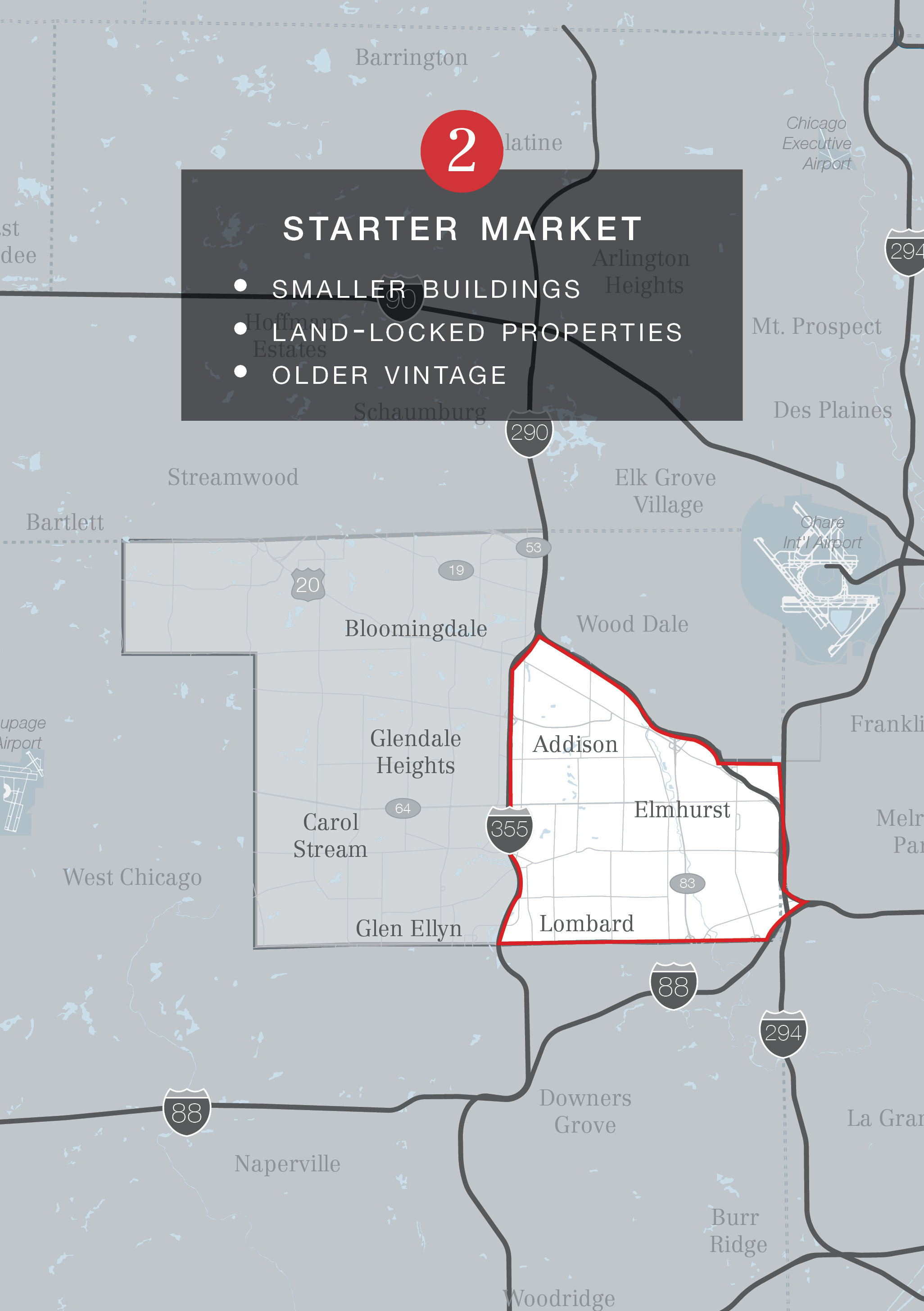

The portion of the Central DuPage submarket located East of I-355 (Addison, Lombard, etc.) has been a prime “starter market” for smaller tenants and owners as it offers traditionally smaller, land-locked buildings that tend to be older vintage.

-

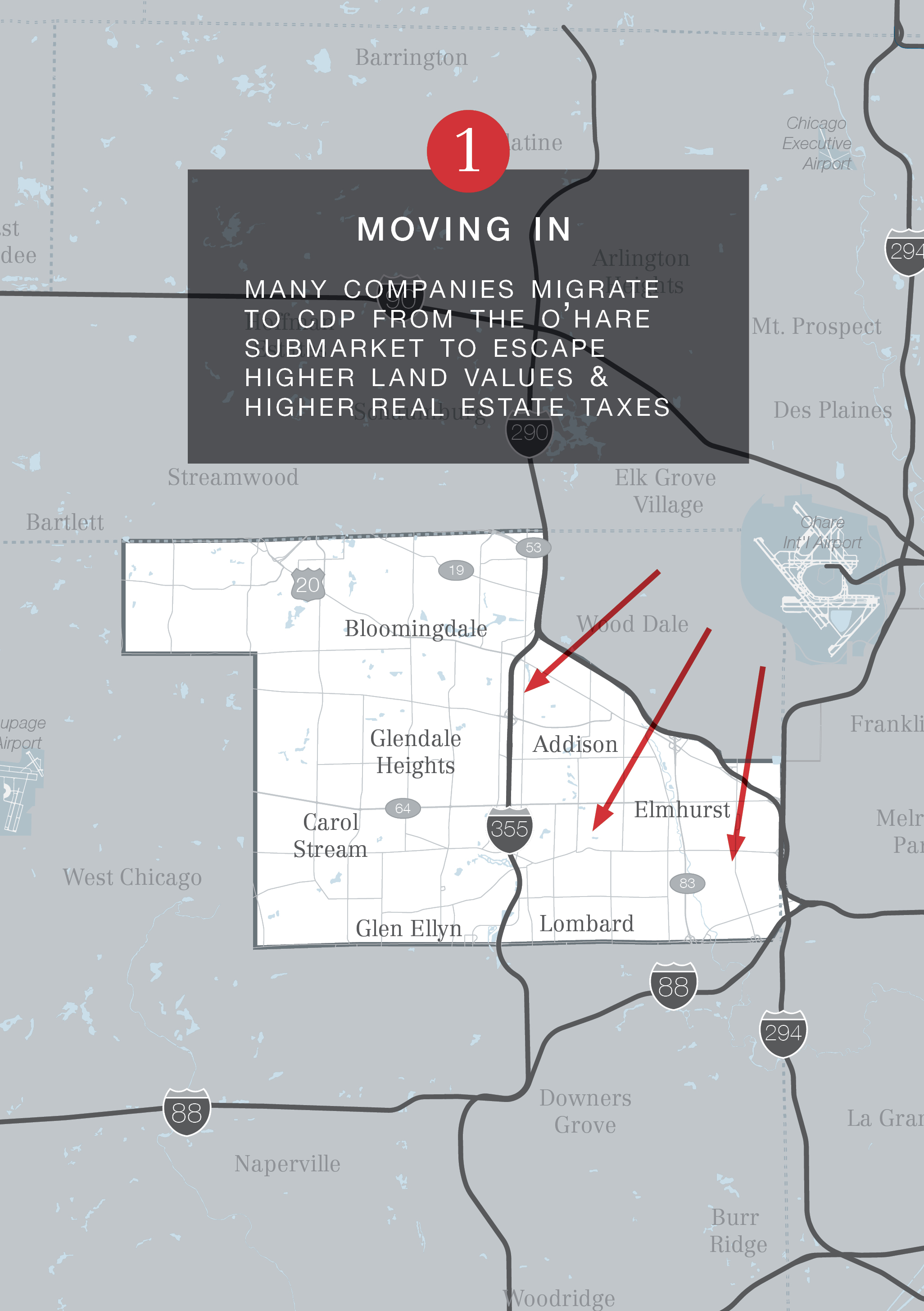

Many companies migrate to the CDP market to escape higher land values and higher real estate taxes near O’Hare in Cook County. In many cases, users also find newer, more functional assets in CDP as compared to the O’Hare market.

-

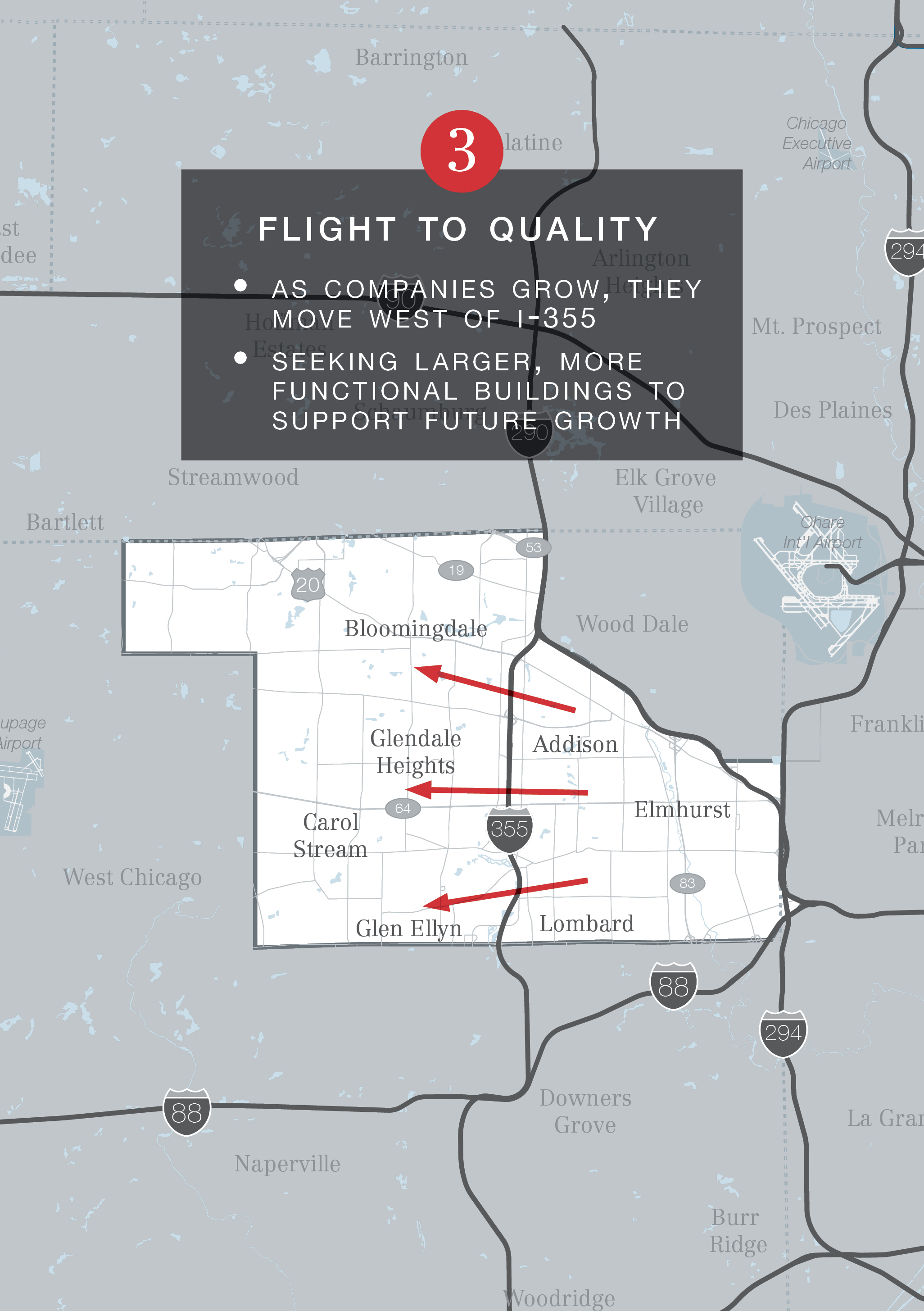

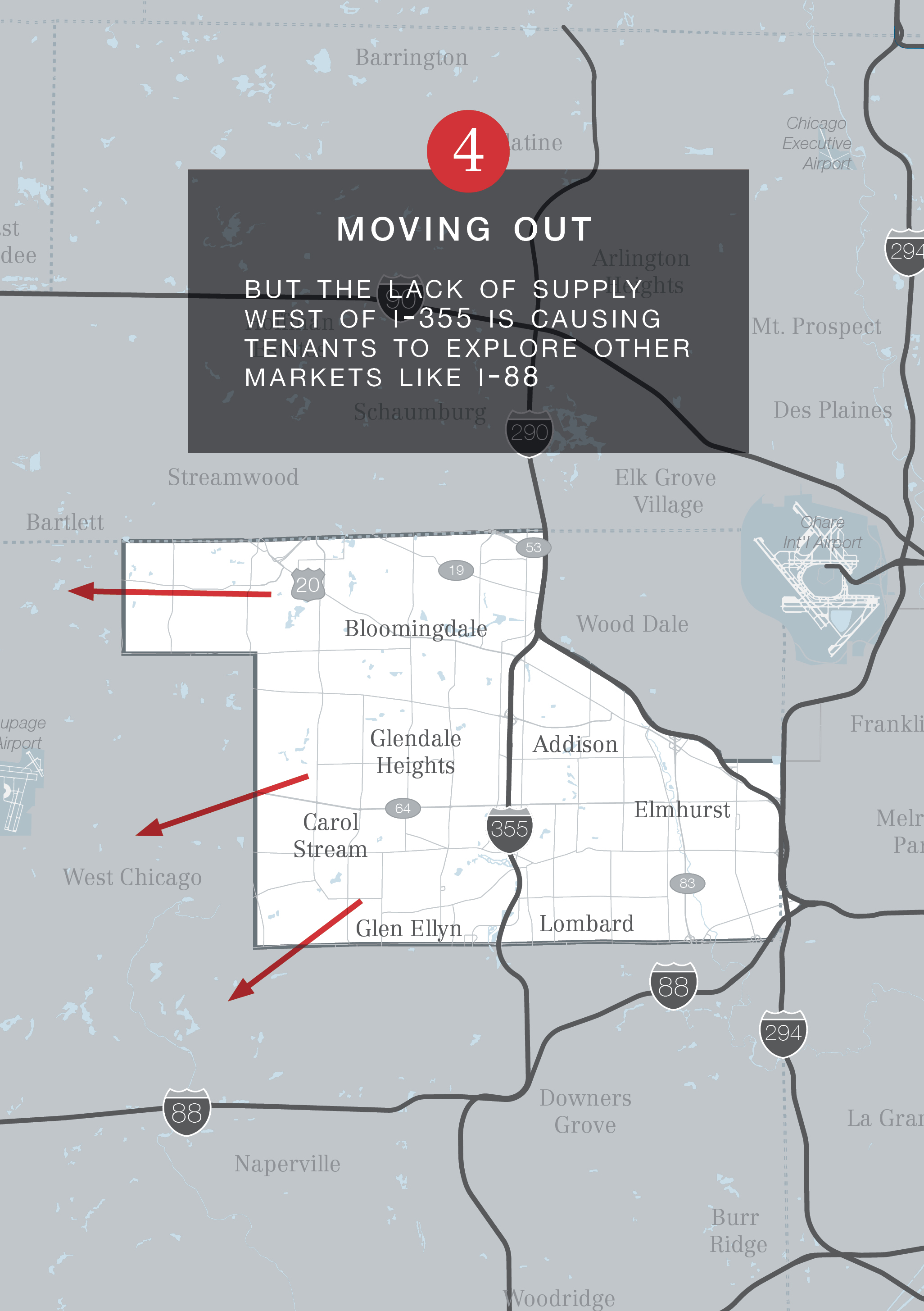

As tenants outgrow their existing facilities, they tend to move further west, seeking larger, more functional assets to support further growth.

-

With Central DuPage’s vacancy rate below 5.0%, it requires a very selective search with a qualified broker to discover vacant functional product west of I-355 that fulfills the qualities tenants are seeking, such as sufficient loading, proper clear height, adequate parking, functional/modern office space, or most importantly, divisibility.

So where are these tenants going?

- If you look at the available options in Central DuPage as of April 1, and your requirement is 24’ clear height or greater, there are limited opportunities. A majority of these availabilities are non-divisible, single tenant vacancies:

- 30,000 – 74,999 SF: you have 9 options

- 75,000 – 149,999 SF: you have 13 options

- 150,000 – 300,000 SF: you have 8 options

- 300,000 SF and larger: you have 1 option

*The vacancies noted above total roughly 3.5 million SF of vacancy. Please contact us if you have questions on any specific available assets.

-

The nearby I-88 submarket has just shy of 5 million square feet of vacancy with nearly 75% (or 3.7 million square feet) of this product being in larger, divisible assets, making it a popular market for tenants to move to.

How owners can attract tenants east of I-355

-

For those buildings in the Central DuPage market that are seen as “functionally obsolete”, there are a number of ways owners can improve their assets to attract and retain established tenants, and accommodate their growth. Owners can improve building functionality through the deployment of additional capital. A few strategic improvements include, but are not be limited to: a roof raise, removing bays to create proper loading, assembling additional parcels to support building expansion, installing modern energy efficient lighting and HVAC systems, additional parking, etc. Any combination of these types of improvements will add to the viability of an aging asset.

-

NAI Hiffman’s industrial brokerage group can provide strategic planning and marketing to assist owners and businesses in improving their assets to attract all types of industrial tenants. For more information, contact:

Michael J. Freitag

mfreitag@hiffman.com

630-693-0652

LinkedIn